Home affordability

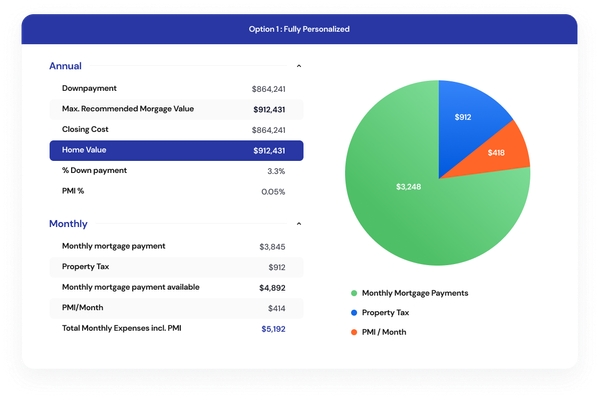

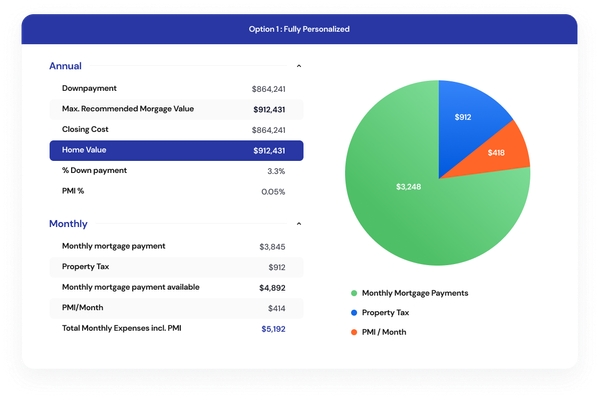

How much house can I afford with my salary?

While thinking about how much house you can afford, consider factors such as debt-to-income ratios, down payment, interest rates, property tax and your lifestyle and expenses.

Home affordability

While thinking about how much house you can afford, consider factors such as debt-to-income ratios, down payment, interest rates, property tax and your lifestyle and expenses.

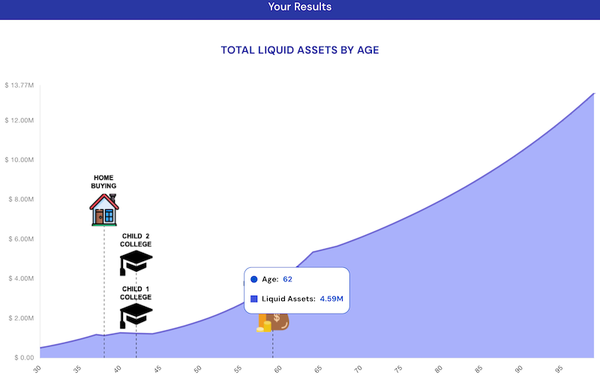

AI financial advisor

Planwell is a fully automated AI financial planner and advisor that helps individuals and families make financial decisions that are hyper personalized to their goals and lifestyle.

financial literacy

Financial affirmations are positive statements that encourage a mindset of optimism and help us manifest wealth. Affirmations can help us get from always being anxious about money towards creating and growing wealth.

Financial Planning

AI financial advice is cost effective & data driven. It can make personalized financial planning accessible to young adults, families and professionals.

Retirement

Here is a step-by-step plan to get on track to retire early at age 55. Create a budget and boost savings and income. Control your retirement lifestyle and expenses. Invest consistently and manage risk

Financial Planning

This is a step-by-step primer to help you plan finances for a new baby and determine whether you can afford a child—or even a second child.

Budgeting

The college savings calculator will let you know exactly how much you need to save to be able to afford college. It will analyze the gap between where you are now, and where you need to be.

Budgeting

An AI Budget calculator uses automation, algorithms or machine learning to help optimize various aspects of your finances, such as budgeting, investing and financial planning.

Financial Planning

These 5 books will teach you all you need to build financial literacy in all aspects of personal finance, including budgeting, saving and investing.

Financial Planning

Discover the top 8 financial planning tips tailored to help young adults secure their future.

Financial Independence

Here are 10 concrete steps to build a comprehensive financial plan.

Financial Independence

FIRE is a financial movement that focuses on achieving financial independence through frugal living, aggressive saving and strategic investing.